Helping our neighbors bank smart and live well

0K32.9KTotal Volunteer Hours

$0M1.6MScholarships Given

0%92%Say Banking Here is Easy

The credit union you need. Service you’ll love.

- Access to 20+ member centers across Michigan

- Monthly cash rewards

- 30,000+ fee-free ATMs

- Low fees

- Express Pay

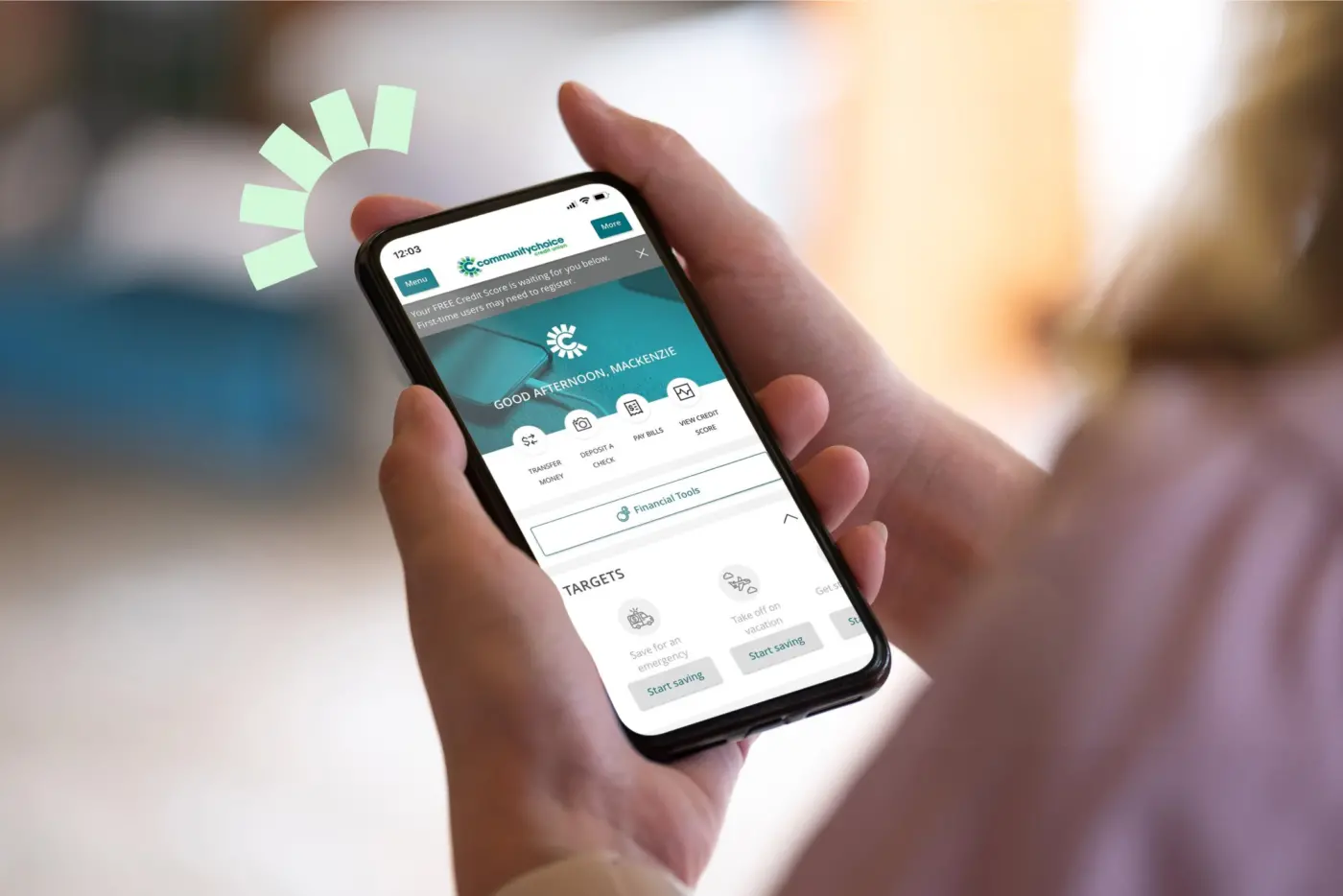

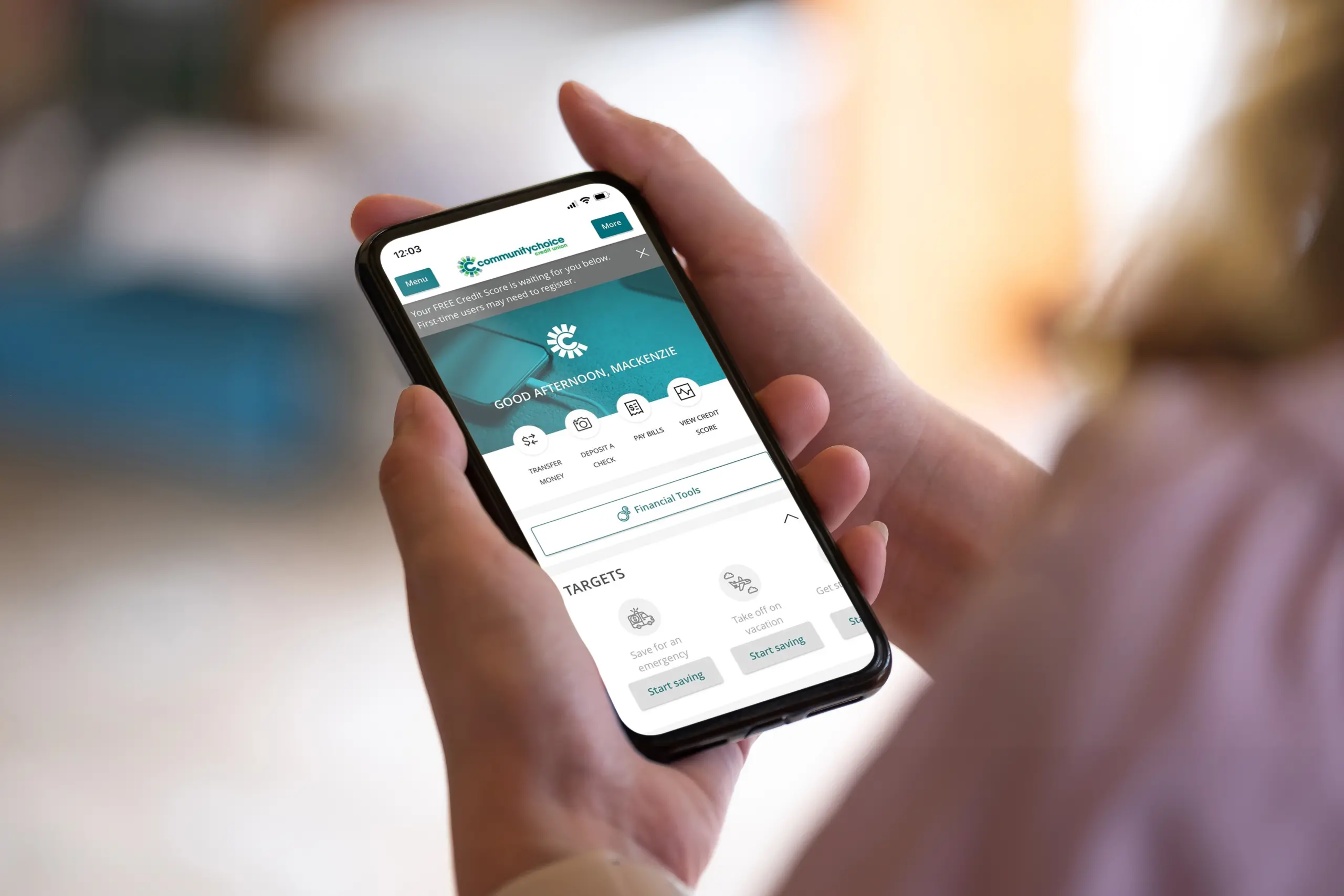

- Targets for savings

Find the smart financial solutions you want from big banking and the one-on-one service you only get from your neighborhood credit union.

Choice Map

A simple path to living well, your way

We help you create a financial wellness plan today that helps you build a more solid financial tomorrow. Get started by talking to one of our Personal Advisors.

Hear from happy members

Check out our latest articles

We’re proud to #GiveBig

Whether we’re filling backpacks, volunteering locally, or helping students reach new heights, we do it all for our communities. Because just like you, we live here, and we want to see all of us thrive.

$0m1.5mscholarships awarded since 2009

0K32.9Khours volunteered since 2008

089years of dedicated service

Bring your best to our team

We love can-do attitudes and people who look forward to working with our team and members. Ready to bring your skills to Community Choice?

Building better community, one member at a time

We know that when our members are living well and enjoying healthier finances, our communities are better off. That’s why we offer smart solutions and great banking benefits.

We’re here when you need us

In Person

Meet with one of our friendly team members at a Member Center near you.

By Phone

If a quick call is all you need, you can reach our member services team by phone.

Online

Existing members can reach out directly through e-Banking – just log in!