BUSINESS CHECKING

Checking that means business

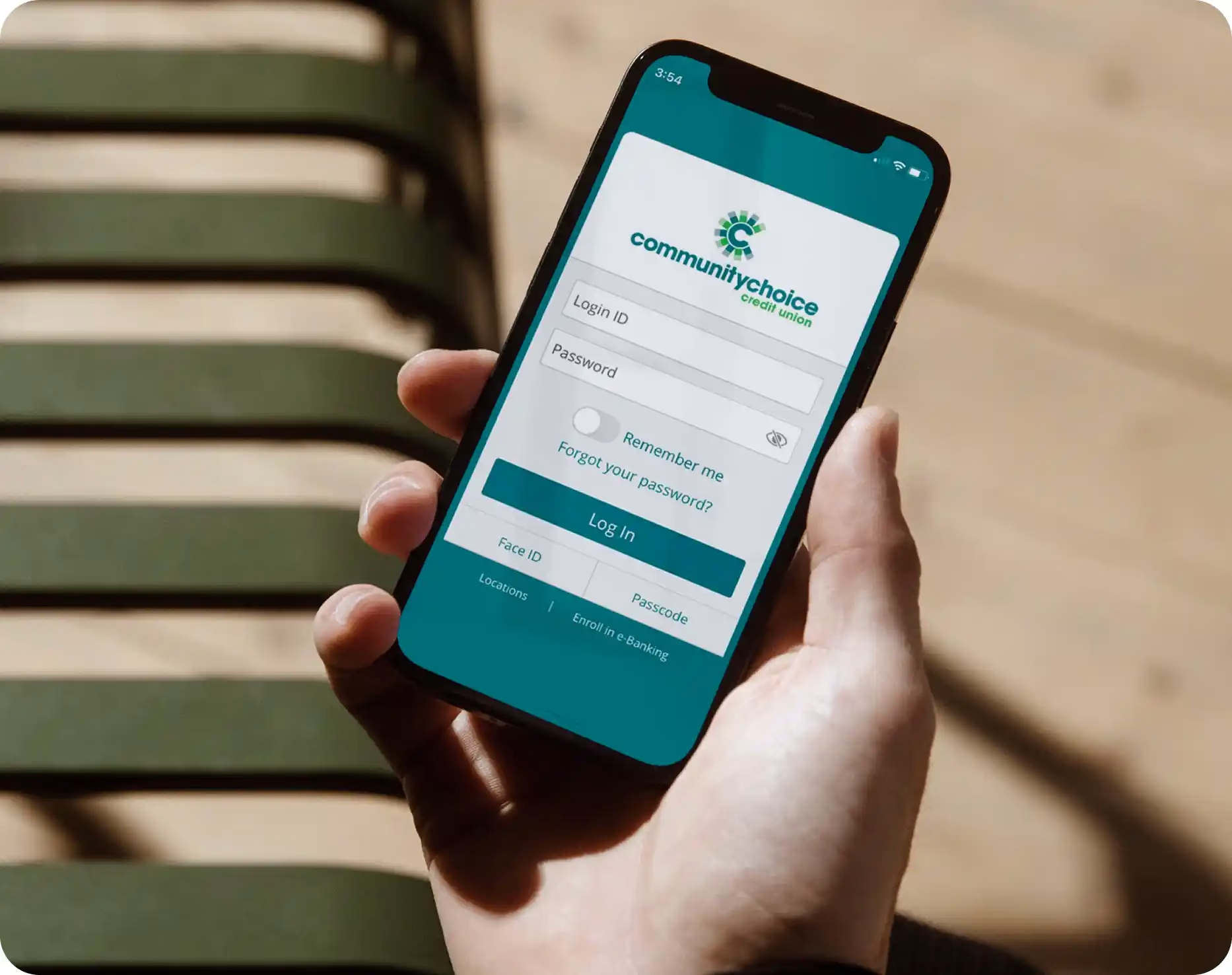

Simple business checking designed to make life easy. Access your funds, make payments, and manage your finances anytime, anywhere.

Options that work for the work you do

Discover a diverse range of business checking options, allowing you to choose the one that best aligns with your unique financial needs and goals.

Hear from happy members

Business Platinum Mastercard®

- No annual fee

- No-fee balance transfer

- Free e-Banking

- 24/7 access

- Low interest rates

Use a range of premium benefits for efficient expense management and secure, rewarding business transactions.

Learn more about our Business Platinum Mastercard.

Business Checking FAQs

Your business checking questions answered. See all frequently asked questions.

Is your business cash working hard enough?

Discover the earning potential of our Business Money Market Account. Competitive rates, easy access, and short-term flexibility make it the smart choice for your business.

Building better community, one member at a time

We know that when our members are living well and enjoying healthier finances, our communities are better off. That’s why we offer smart solutions and great banking benefits.