Personal Savings

Sit back, watch your personal savings grow

Easily maximize your savings potential with our competitive rates and flexible savings options.

Choice Savings gets you there

Set your goals and meet them with increased earned interest as your balance grows.

CD ladders made easy

CD laddering with Community Choice Credit Union provides easier access to funds and more flexibility than a single Certificate of Deposit, while still offering guaranteed cash and financial security.

Banking made easy so you can take it easy

Savings Rates*

Risk-free savings with Certificates of Deposit

Maximize your interest without the risk when you open a Certificate of Deposit at Community Choice Credit Union. You can start earning on a short-term CD with as little as $500. Interest is paid based on your balance. The more you save, the more you earn.

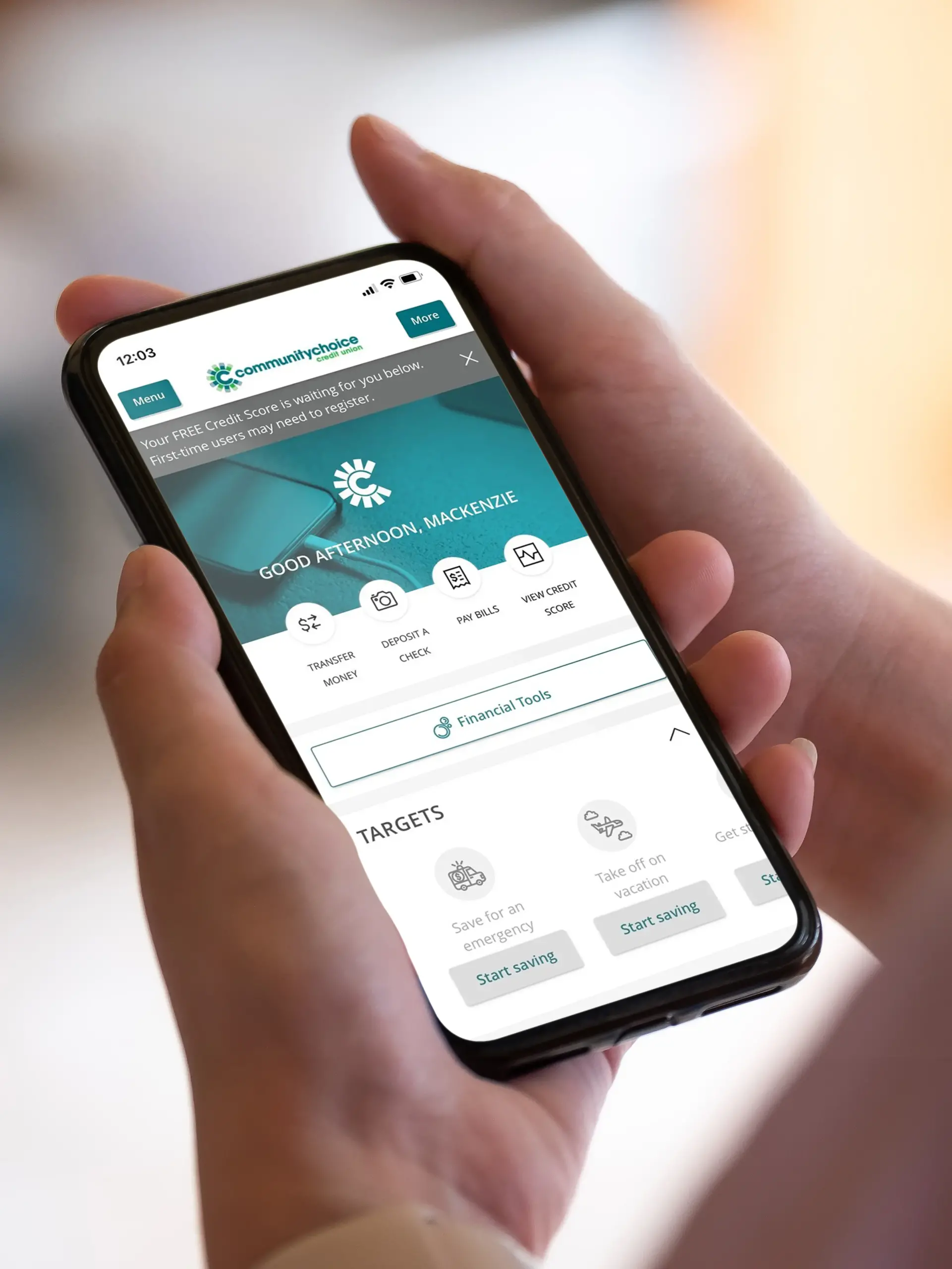

Targets

Organize your savings with Targets. It’s easy to do and helps you keep your savings aligned with your goals. Open Targets anytime in e-Banking and we’ll help you automate your way to savings success.

Current rates

Compare rates for Choice Savings, IRAs, CDs, credit cards, and available loans.

Hear from happy members

Retire with confidence with a Community Choice IRA

Enjoy the benefits of an IRA suited to your personal retirement goals. With multiple choices of terms, and insurance of up to $250,000, you reap the rewards of competitive rates without the risk.

Free digital banking

Bank from anywhere with online and mobile access. Manage accounts and loans from your computer, tablet, or phone.

Mobile app

Control your accounts, monitor spending, transfer money, and do it all securely from your phone.

e-Deposit

Easily deposit a check into your accounts from your phone with a simple photo.

Apple Pay & Google Pay

Make convenient, secure payments when you add your Community Choice credit or debit card.

Card controls

Take charge of how your cards are used, including automatically limiting purchases by transaction type and location.

Emergency funds

Our self-serve Express Cash loans provide money with only 6 clicks in 60 seconds.

Goals made easy

Our Targets tool lets you set savings goals and auto transfers via e-Banking.

Personal Savings FAQs

Your personal savings questions answered. See all frequently asked questions.

Building better community, one member at a time

We know that when our members are living well and enjoying healthier finances, our communities are better off. That’s why we offer smart solutions and great banking benefits.

*APY = Annual Percentage Yield

Dividends will be paid monthly based on the aggregate balance of your Choice Savings Account and Choice Goals. The combined dividend will be deposited into your Choice Savings Account. $5.00 min. to open. All rates subject to change at any time without notice. For more information, please refer to our Account Agreements and Disclosures.