SAVINGS

Simple access, powerful coverage

With an Extended Insurance Account, you can access all your accounts in one place, manage them easily through e-Banking, and enjoy a dedicated specialist to guide you through the easy setup process. And, it’s all safely insured under the NCUA.

Protecting and growing your money just got easier

Community Choice Credit Union offers Extended Insurance Accounts, a unique product that conveniently offers access to millions of dollars in NCUA (National Credit Union Administration) share insurance* through credit unions in the ModernFi Network.

The Extended Insurance Account is designed to not only safeguard your funds with extended NCUA share insurance, but also to help your money grow through competitive interest rates. With this account, you can maximize your share insurance coverage while enjoying flexible access to your funds in demand deposit accounts.

Convenient, accessible, and effortless

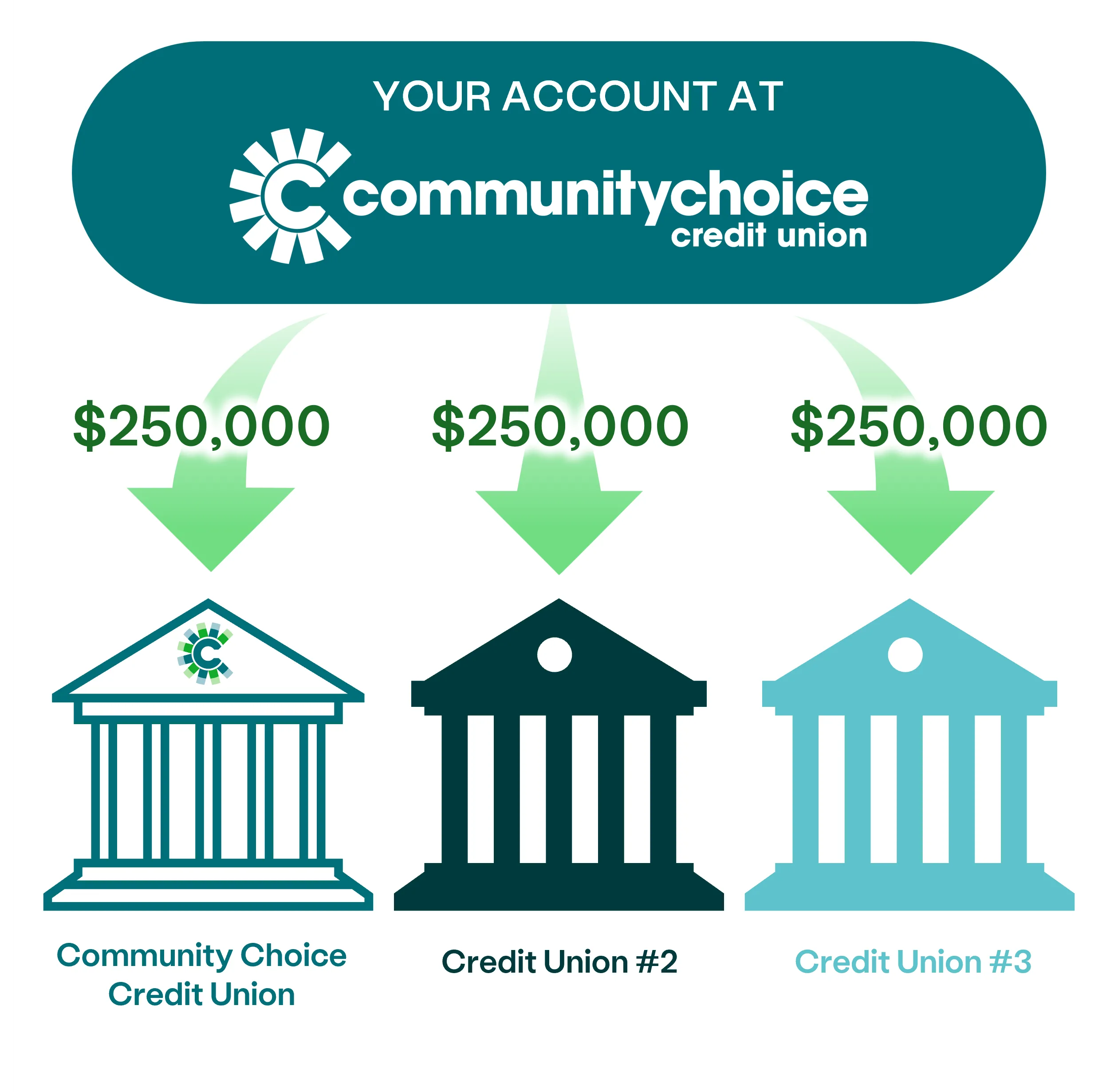

An Extended Insurance Account provides millions of dollars in extended NCUA insurance on your deposits by distributing your balances in amounts under the $250,000 threshold to partner credit unions in the ModernFi network. By placing funds under the limit, your entire balance can be insured by the NCUA. These accounts combine to provide you with extended insurance coverage.

How it works, simply and securely

Suppose you have $1 million that you want to safeguard and earn interest on. You can achieve this by depositing the full amount with Community Choice Credit Union through an Extended Insurance Account. The money is then distributed into smaller portions and placed in demand deposit accounts at various credit unions within the network.

The first $250,000 will be allocated to Community Choice Credit Union, another $250,000 to Credit Union 2, an additional $250,000 to Credit Union 3, and the remaining $250,000 to Credit Union 4. All of these credit unions are partnered with the ModernFi Network. This allocation helps ensure that each dollar is covered by NCUA share insurance, in an amount up to the maximum of $250,000 per share owner per credit union.

Get started with one easy click!

Opening an Extended Insurance Account with Community Choice couldn’t be easier. Just click below to make an appointment with one of our financial experts today!

Your money is worth its weight in goals

Ready to live the life you desire? A Choice Savings account makes it easier to set and accomplish your savings goals. Better yet, you have complete control over your Choice Goals within e-Banking. Separate your balances and name them to save for specific reasons.

- Wedding

- Nursery furniture

- Family vacation

- House down payment

Hear from happy members

Better banking for you is our business

Business owners are the backbone of our communities, and we take pride in making sure they’re covered with accessible banking resources, specialized support, and modern tools to simplify day-to-day operations.

*Insurance provided through program credit unions subject to certain conditions.