Unlocking the Simplest Path to Your Dream Home: A Friendly Guide to Simplified Renovation Financing

Getting a home renovation loan can feel overwhelming — but it doesn’t have to be. Community Choice Credit Union offers a RenoFi renovation loan based on the post-renovation value of your home. That means you can access more funds upfront — without refinancing your first mortgage or waiting through multiple draw cycles.

Imagine your loan covers your full vision, right from the start

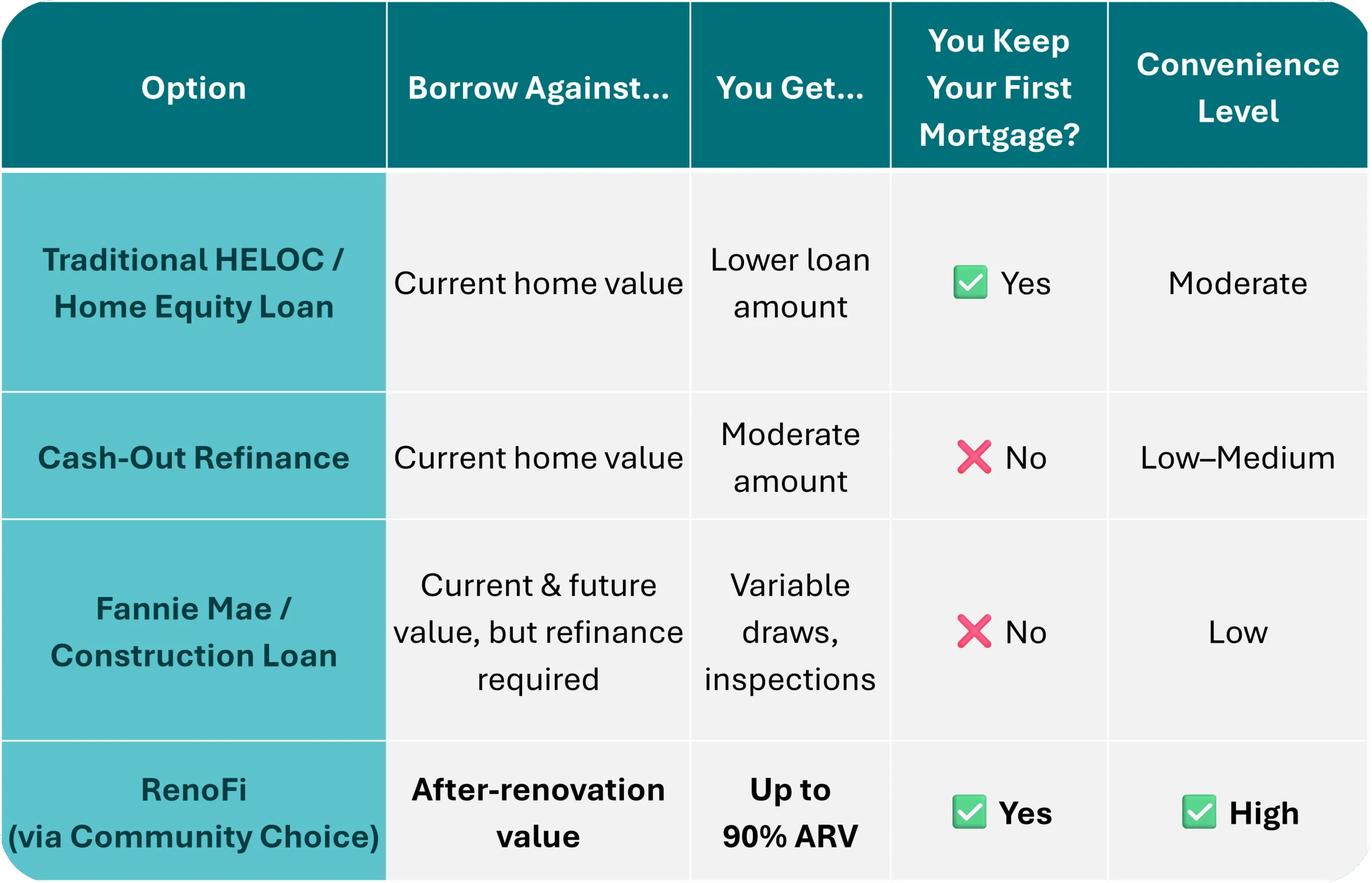

Traditionally, home equity lines of credit (HELOCs) or cash-out refinances are based on today’s home value. That often leaves a gap between what you can borrow and what your project actually needs. But RenoFi flips that script: loans are based on the after-renovation value of your home.

For example:

- Your home is worth $200,000 today.

- You plan a renovation worth $50,000.

- Post-project value: $250,000.

- At 90% LTV, RenoFi lets you borrow against that future $250,000 — not the current $200,000.

Instantly, you unlock $75,000 instead of only $30,000. That’s huge when every dollar counts — and the process couldn’t be more straightforward.

No refinancing, no draws, no hassle

- No need to refinance your first mortgage — keep your low rate intact.

- You have access to your funds any time during the first 2-year draw period: you have the option to draw all the funds at once or take multiple draws throughout the draw period.

- Help with contractor introductions.

- No project-phase inspections.

Real projects, big or small

Whether you’re updating a kitchen, finishing a basement, adding a master bath, or tackling a full remodel, the RenoFi loan is built to make it a reality.

- Borrow up to 90% of post-renovation value.

- Choose a HELOC loan structured to suit your budget and timeline.

- Convenient repayment terms of 20 years to help lower your monthly payment.

- No penalty for early payoff — your renovation, your choice.

That level of accessibility empowers homeowners to dream big — and make it happen.

Seamless online experience from anywhere

Time is precious, and digital-first processes make all the difference:

- Apply and upload plans online through easy forms.

- Digital closing — no travel required.

- A dedicated RenoFi advisor keeps things rolling — no mystery, no guesswork.

- Transparent status updates — stay informed without hassle.

Combine that with Community Choice’s local service, and you get a friendly, clear, and highly convenient renovation-financing journey.

Protecting your current mortgage is easy

One of the clearest perks: you get to keep your current mortgage — even if your rate is low. Unlike cash-out refinancing or Fannie Mae HomeStyle, RenoFi keeps your rate untouched as a second mortgage.

This matters. Why give up a 3% rate just to renovate?

Community Choice RenoFi loans respect what you already have — and enhance your future.

Fast closing, quick access to funds

Timing matters, whether you’re tapping seasonal contractor availability or starting a project with urgency. Community Choice delivers:

- About 2-week average closing after online application.

- RenoFi users can close in as soon as 30-45 days.

- Funds are available three days after closing/signing.

Your renovation can begin on time, with confidence, and with funds in-hand.

Crunching the numbers: borrow smarter

Let’s do a quick comparison. The RenoFi route is clearly built for convenience, accessibility, and real-world homeowner needs.

See how worry-free your renovation can be!

Here’s how to get started:

Talk to our expert financial partners at RenoFi to outline your project and see how much you can borrow.