International Credit Union Day celebrates the spirit of “people helping people”

Each October, communities around the world celebrate International Credit Union Day, a tradition that began in 1948. This year, on October 9, 2025, Community Choice Credit Union is proud to join in once again celebrating our members and honoring the idea of “people helping people” that has guided our movement for over a century.

But where did credit unions come from? And why do they still matter so much today for families, small businesses, and everyday people looking for a safe, supportive place to manage their money?

Let’s take a quick journey together!

Humble beginnings: 19th Century roots

The credit union story begins in Europe in the mid-1800s. At the time, banking was almost entirely reserved for the wealthy. Ordinary workers and farmers often turned to moneylenders who charged sky-high interest, trapping people in cycles of debt.

That’s when a new idea took hold: what if neighbors pooled their resources to provide fair, affordable loans to one another?

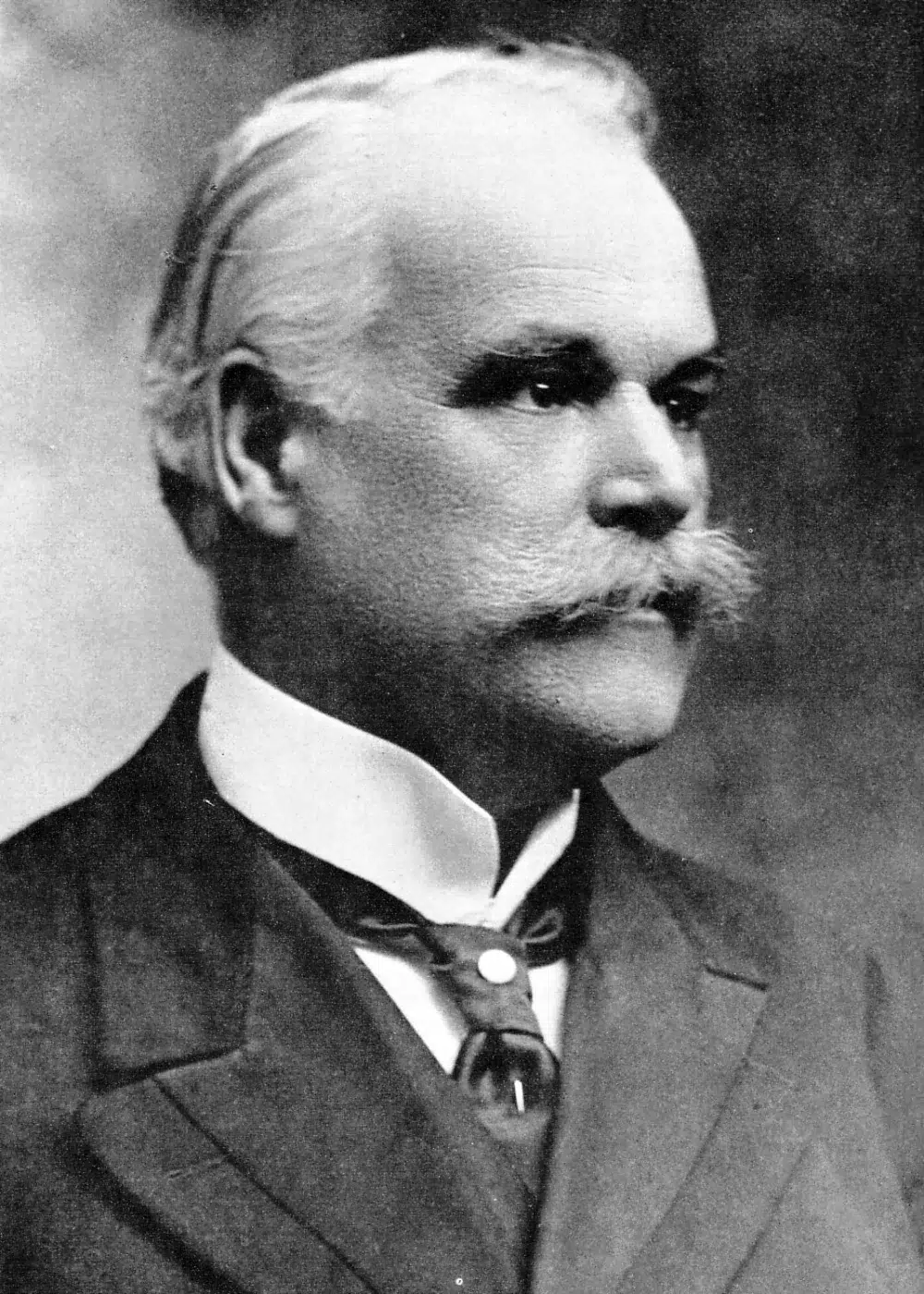

In Germany, pioneers like Friedrich Raiffeisen and Hermann Schulze-Delitzsch organized cooperative lending societies. Members contributed small savings to a common fund, and those funds were then lent back to members in need. The idea was simple but powerful: community-owned financial institutions where members – not outside investors – call the shots.

The movement comes to North America

The concept spread quickly. In 1900, a French-speaking journalist named Alphonse Desjardins established the first credit union in North America in Quebec, Canada. Just eight years later, the idea crossed into the United States with the founding of St. Mary’s Cooperative Credit Association in Manchester, New Hampshire.

Credit unions grew out of necessity. Immigrants, farmers, and working-class families (people often overlooked by traditional banks) suddenly had a safe place to save money and borrow at fair rates. These were institutions built on trust, run by members for members.

Growth through the 20th Century

By the 1930s, during the Great Depression, credit unions were a lifeline for families struggling to make ends meet. In 1934, President Franklin D. Roosevelt signed the Federal Credit Union Act, officially recognizing credit unions as an important part of the U.S. financial system. Over the decades, credit unions multiplied across the country. They became fixtures in towns and cities, offering not just loans and savings but also a sense of belonging. Members weren’t customers; they were owners. And that distinction mattered.

The Community Choice story

Here in Michigan, Community Choice Credit Union is proud to be part of that legacy. In 1935, long before smartphones and mobile deposits, a handful of neighbors in Redford Township met in the home of Arthur and May Jenkins with a simple but powerful belief: we can trust one another better than a big bank ever could.

Over the years, we’ve grown, expanded to other states, had some name changes, and welcomed many other organizations into our family. Through it all, we’ve stayed true to who we are, and we’ve never forgotten the people we serve. Today, that’s over 116,000 members, all united by the same core belief: that community comes first, and that each member deserves personal care and service.

As we’ve expanded, we’ve never lost sight of our mission: to offer easy, convenient banking that supports your life – whether that means running a household, managing a business, or simply finding smarter ways to save.

We’ve also never lost sight of giving back, and Community Choice invests in our communities. We sponsor local non-profits, volunteer time, and support small businesses. We believe financial well-being is the foundation of strong, thriving neighborhoods. The more we Give Big, the more we believe in giving back even bigger.

Why credit unions still matter today

You might wonder: do credit unions still hold the same value as they did 100 years ago? The answer is a resounding yes. Here’s how Community Choice can make a real difference in your life:

Those are just a few of the things that set credit unions apart!

International Credit Union Day: a tradition since 1948

Every October, credit unions around the world unite to celebrate International Credit Union Day. Launched in 1948 by the Credit Union National Association (CUNA) and now led by the World Council of Credit Unions (WOCCU), this day honors the history, achievements, and future of the movement.

But it’s more than just a celebration. It’s a reminder of how far we’ve come, and how much good credit unions can do together. From small farming villages in Europe to bustling cities in the U.S. and beyond, the credit union philosophy connects us all: financial services should be fair, convenient, accessible, and built for people, not profits.

Join us in celebrating International Credit Union Day!

This October 9, we’re inviting our community, our members, and their friends and families to join us at our Community Choice Member Centers as we celebrate International Credit Union Day! It’s our chance to thank you for being part of this incredible movement and bring our neighbors together. Expect warm smiles, a festive atmosphere, free meals and a chance to connect with the people who make our credit union strong.

Bring your family, bring a friend, and most importantly, bring your story – because every member’s story is part of the credit union story.

Here’s to the past, present, and future of people helping people with Community Choice Credit Union!

Not a member yet?

You’re more than welcome, too!

We’d love to show you how becoming a member of Community Choice Credit Union can help you enjoy a new, stress-free way to manage your finances!