Checking

Checking that simplifies

your life

- 24/7 access and support with mobile and e-Banking

- Get your paycheck early with Express Pay

- 30K+ fee-free ATMs and 20+ member centers

Everyday banking done easy

Stress-free checking with all the perks

24/7 access no matter where you banking from, shopping and identity security, and savings on travel and more. It’s all in one interest-earning account—Choice Checking.

Choice Checking Rates*

Keeping it simple? Basic Checking is your match

Our Basic Checking is the straightforward solution for the no-frills member. Enjoy the same 24/7 account access, online banking, and a free Debit Mastercard®.

- Free e-Banking, e-Pay, and e-Deposit

- No monthly charge with e-Statements

- No monthly account fee or minimum balance

Looking for a checking account? You have options.

Enjoy the convenience and ease of Basic Checking, or take it to the next level with Choice Checking.

Exclusive Member Benefits | Choice Checking | Basic Checking |

Universal access to mobile banking and e-banking | icon-check | icon-check |

Fastest access to funds with direct deposit and Express Pay | icon-check | icon-check |

Safety and security with debit card controls | icon-check | icon-check |

Service at 20+ member centers and over 30,000 fee-free ATMs | icon-check | icon-check |

Optional overdraft protection | icon-check | icon-check |

Unlimited financial guidance from a credit union-certified financial counselor in our Choice Map program | icon-check | icon-check |

Interest-earning (balances over $2,500) | icon-check | |

Free Paper Statements | icon-check | |

Travel and Leisure Discounts, $hopping RewardsTM, and Health Discount Savings | $300 Estimated Yearly Savings | |

IDProtect® Identity Theft Monitoring and Resolution Service1 | $120 Estimated Yearly Savings | |

Up to $10,000 AD&D Insurance2, Debit Advantage®2, and Cellular Telephone Protection2 | $120 Estimated Yearly Savings | |

$5.95 Per month |

Terms and Conditions

*Registration/activation required.

- Benefits are available to personal checking account owner(s), their joint account owners and their eligible family members subject to the terms and conditions for the applicable Benefits. Some Benefits require authentication, registration and/or activation. Benefits are not available to a “signer” on the account who is not an account owner or to businesses, clubs, trusts, organizations and/or churches and their members, or schools and their employees/students. Family includes: Spouse, persons qualifying as domestic partner, and children under 25 years of age and parent(s) of the account holder who are residents of the same household.

- Special Program Notes: The descriptions herein are summaries only and do not include all terms, conditions and exclusions of the Benefits described. Please refer to the actual Guide to Benefit and/or insurance documents for complete details of coverage and exclusions. Coverage is provided through the company named in the Guide to Benefit or on the certificate of insurance. Insurance products are not insured by NCUA or any Federal Government Agency; not a deposit of or guaranteed by the credit union or any credit union affiliate.

- You will have access to your credit report and score provided your information has been verified by the CRA. Credit Score is a VantageScore 3.0 based on single bureau data. Third parties may use a different VantageScore or a different type of credit score to assess your creditworthiness. Once you have activated credit file monitoring, you may request your credit score. Once you have done so, you will have access to you score on a monthly basis.

Celebrate convenience with Mastercard®

- Speed through checkout online and in stores

- Safeguard against loss or theft with Mastercard ID Theft Protection™

- Tap to pay in stores where you see the contactless symbol

- Access 30,000+ fee-free ATMs

- Receive your digital card right away! Learn more

Universally accepted, your Debit Mastercard keeps payments and purchases fast, easy, and secure.

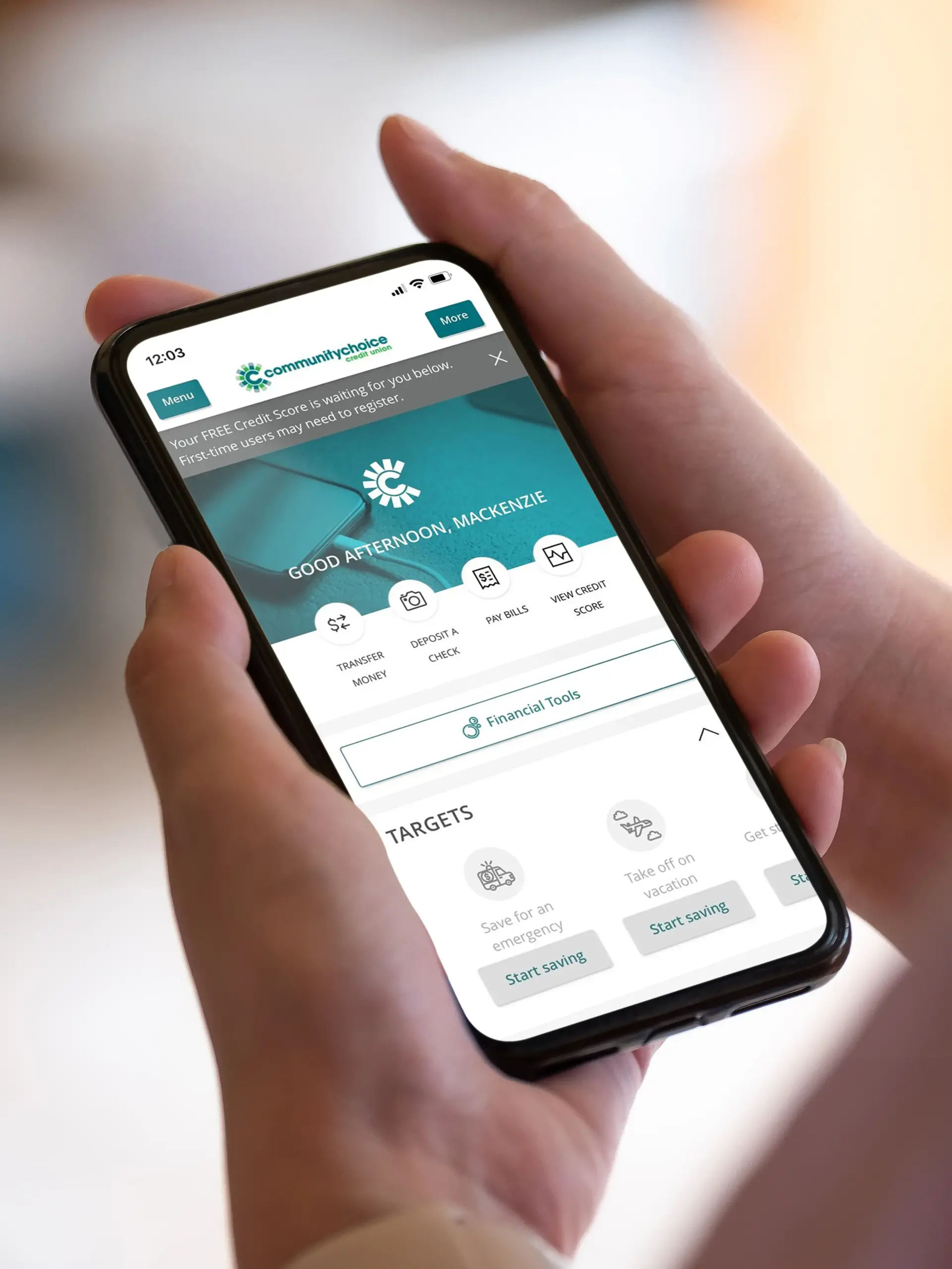

e-Banking anywhere

Our mobile app and e-Banking keep you in tune with your spending, goals, deposits, and transfers all from your phone or desktop.

Access it all from your phone

Control your accounts, monitor spending, transfer money, and do it all securely from your phone.

Deposit from anywhere

Easily deposit a check into your accounts from your phone with a simple photo.

Keep payments easy

Make convenient, secure payments when you add your Community Choice credit or debit card to Apple Pay or Google Pay.

Manage your cards

Take charge of how your cards are used, including automatically limiting purchases by transaction type and location.

Get cash when you need it

Our self-serve Express Cash loans provide money with only 6 clicks in 60 seconds.

Set goals and reach them

Our Targets tool lets you set savings goals and auto transfers via e‑Banking.

Personal Checking FAQs

Your Choice Checking and Basic Checking questions answered. See all frequently asked questions.

Bank with a credit union that puts you first

We know that when our members are living well and enjoying healthier finances, our communities are better off. That’s why we offer smart solutions and great banking benefits.

Terms and Conditions

*APY = Annual Percentage Yield

Equal Housing Opportunity.

No minimum deposit is required to open a Choice Checking account. Basic Checking accounts are non-interest bearing. Fees may reduce earnings. For a complete list of fees, please refer to the credit union’s Fee Schedule. All annual percentage yields are accurate as of the last dividend declaration date and are based on the assumption that funds remain on deposit for the entire dividend period. Dividend rates on share accounts are declared monthly by the Board of Directors and posted on the last day of every month. All rates are subject to change at any time without notice. For more information, please refer to our Agreements & Disclosures.

**Registration/activation required.

1. Benefit Eligibility

Benefits are available to personal checking account owner(s), their joint account owners and their eligible family members subject to the terms and conditions for the applicable Benefits. Some Benefits require authentication, registration and/or activation. Benefits are not available to a “signer” on the account who is not an account owner or to businesses, clubs, trusts, organizations and/or churches and their members, or schools and their employees/students. Family includes: Spouse, persons qualifying as domestic partner, and children under 25 years of age and parent(s) of the account holder who are residents of the same household.

2. Insurance and Benefits Disclosure

The descriptions herein are summaries only and do not include all terms, conditions, and exclusions of the benefits described. Please refer to the actual Guide to Benefit and/or insurance documents for complete details of coverage and exclusions. Coverage is provided through the company named in the Guide to Benefit or on the certificate of insurance. Insurance products are not insured by NCUA or any federal government agency, nor are they deposits of or guaranteed by the credit union or any credit union affiliate.

3. Credit Score Access and Monitoring

You will have access to your credit report and score once your information has been verified by the credit reporting agency (CRA). Credit Score is a VantageScore 3.0 based on single bureau data. Third parties may use a different VantageScore or a different type of credit score to assess your creditworthiness. Once you have activated credit file monitoring, you may request your credit score. After doing so, your score will be updated monthly and available for review at any time.

Express Pay for direct deposit is available for all Community Choice members that set up a direct deposit with their employer or paying agency. Early direct deposit eligibility may vary between pay periods and timing of paying agency’s funding.