Cannabis Business Services

Growing your business together

We’ve invested in what truly matters: a dedicated team of industry experts ready to support your Florida cannabis-related business with the white-glove service you deserve. From seamless cash handling to high-yield lending solutions and compliance services, we’re here to help you cultivate success.

Full-service support

Rather than brick-and-mortar branches, we’ve cultivated a full-service team available anytime, anywhere. You’ll have one-on-one guidance from our seasoned experts, making sure you have the best support in the industry — without ever needing to leave your business.

Helping our neighbors bank smart and live well

0K39.2KTotal Volunteer Hours

$0M1.6MScholarships Given

089Years of Service

Choice Cash Checking

Cultivate more income with an interest-earning checking account designed just for cannabis business owners. Manage all your financial needs online, including:

- Transfers

- Statements

- Deposits

- Bill pay

Choice Cash Services

Keep your green secure and your finances in the highest of spirits. Say goodbye to monetary mysteries and hello to high-profit precision.

- Choice Cash Checking

- Business Savings Account

- Armored vehicle services

- Smart vaults & cash bags

- Domestic wire transfers

- Domestic ACH origination

Green-friendly lending

To learn more about what Community Credit Union can do for your operation, contact our team today!

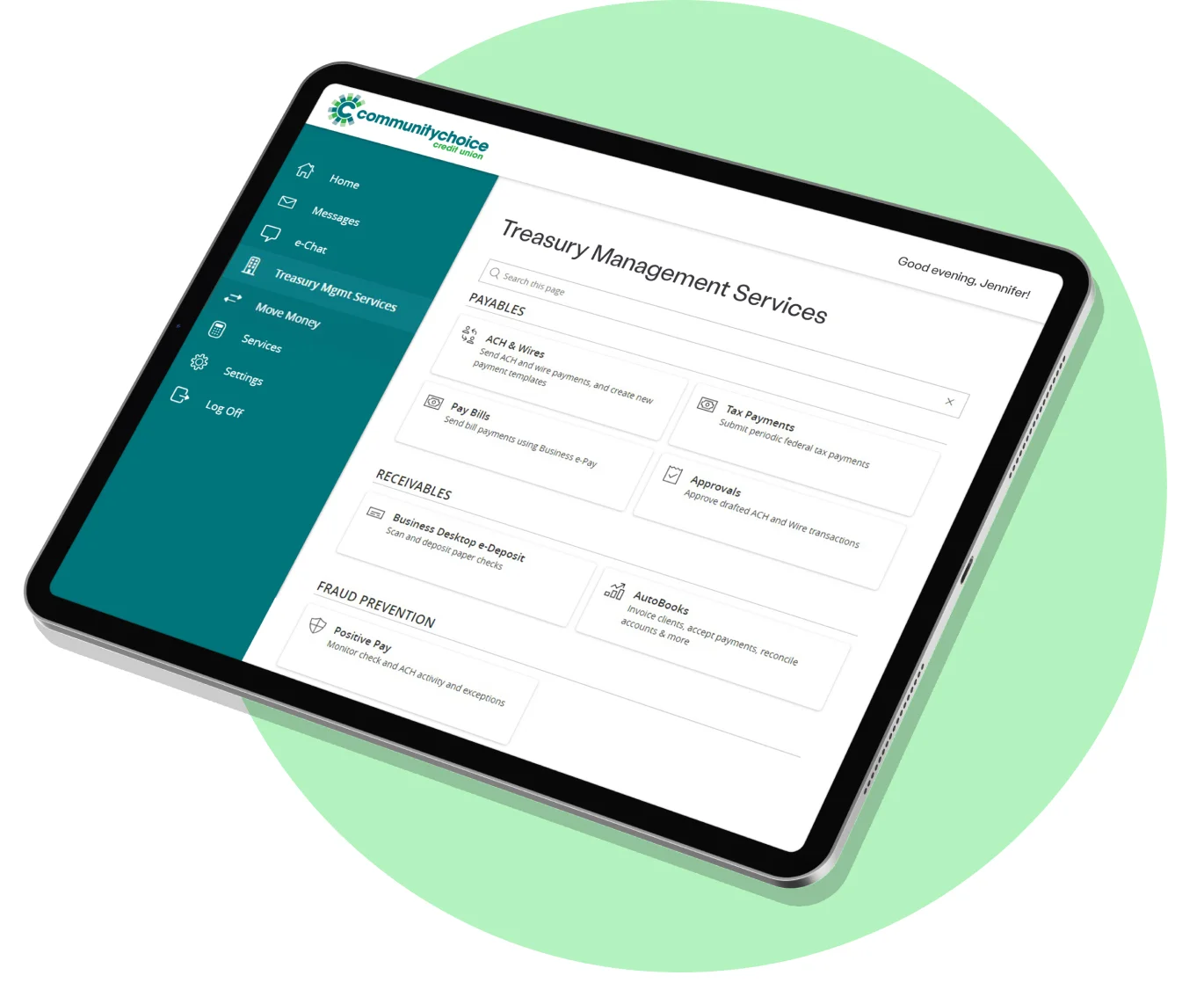

Treasury Management Services

Unlock the full potential of your cannabis-related business with our comprehensive Treasury Management Services, designed to safeguard your assets and streamline your finances. Partnering with Tru Treasury, we offer tailored solutions to maximize your cash, reduce expenses, and control risk. Our services include:

- Payables: Secure payment solutions like payroll services and ACH origination.

- Receivables: Enhance cash flow and mitigate fraud with streamlined collections.

- Fraud Prevention: Protect your business against payment fraud.

- Liquidity Management: Access multiple deposit and cash management solutions.

Better banking for you and your team

Take advantage of our variety of products and loans designed to help your business and your team thrive.

Hear from happy members

Here to help you succeed

Toros Bardakjian, Cannabis Banking Professional Advanced Certification™, our lead industry specialist, is ready to provide personalized support to help you stay compliant, efficient, and successful—without needing a physical branch. Let’s grow together.

Toros Bardakjian

Business Development Manager

State of Florida

P: 877.243.2528 ext. 1632

C: 248.770.1910

Stay informed.

What do you get when you combine your expert cannabis business know how with our expert financial partnership? Magic. Receive emails about our products, services, and events. We promise no spam, just sharing information tailored to you and your team’s money management needs.