5 e-Banking Tips & Tricks to Add Simplicity to Your Life

Fact: Life gets busy.

Between shuttling kids to after-school activities, keeping up with the yard work, and getting lost down the occasional TikTok rabbit hole, your time has never been at such a premium. Not to mention your daily commute—of course, you may be working from the couch these days.

In hopes of providing you some much needed relief, let’s explore a few e-Banking features that are certain to add some simplicity to the equation.

1. Be On Alert

With everything you have on your plate, customized e-Alerts will keep you on top of things that matter most. You can schedule your alerts to be delivered between 7 a.m. – 10 p.m.

To begin choosing which e-Alerts you wish to receive, log in to e-Banking, select Settings, then select Alerts. Here’s a quick tutorial:

2. Get Mobile

Away from your computer? No problem. Accessing your accounts on the go with the Community Choice e-Banking app is amazingly convenient. You’ll have a complete overview of your finances wherever your day takes you.

Get the app

You can also text CCCUMOBILE to 8772432528.

3. What’s on Tap

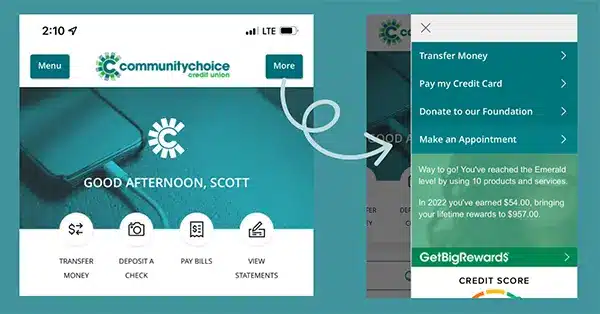

Quick links on the e-Banking homepage make it very convenient to complete frequent tasks like transferring money or paying bills. But wait, there’s more! No, really; There’s literally a More button in the e-Banking app. Tap away to reveal a slideout feature filled with hidden gems you might frequently use such as Pay my Credit Card or Make an Appointment.

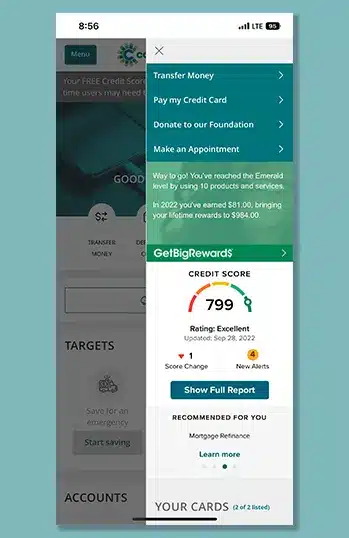

4. Know the Score

While you’re exploring this section of the app, scroll down a bit to reveal Credit Score, powered by SavvyMoney. This is a great place to take a quick peek at your current credit score and monitor any recent changes. Want to dive in further? Tapping Show Full Report opens the full power of Credit Score, giving you access to a detailed analysis of your score, alerts, recommendations, offers, and more.

5. Targets

We care deeply about helping members set, reach, and achieve their financial goals. That’s why we’ve created Targets, coming to e-Banking on October 4. Targets will help you save for the reasons that are most important to you, and can even add some simplicity to your life.

It’s easy: You choose the dollar amount you want to save and establish a timeline to achieve that goal. Targets can save you time by determining how much money you’ll need to set aside on a set frequency, then transfering the money automatically into your Targets. Talk about convenient! Here’s a preview:

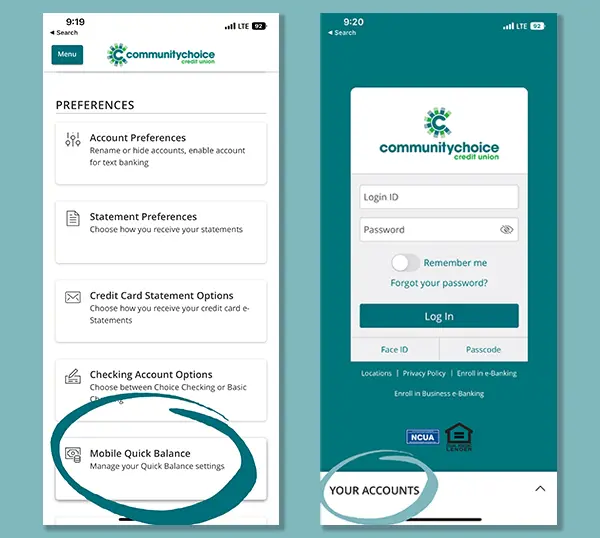

BONUS TIP! Quick Balance

Did you know you don’t even have to log in to the e-Banking app to see your balances? Enroll in Mobile Quick Balance by visiting the Settings menu. The next time you open the app, tap Your Accounts for a glimpse at how things are looking.