Protect Yourself and Your Money

Fraud is getting more sophisticated—and faster. From fake text messages and phishing emails to urgent-sounding calls that seem just a little too real, scams are constantly evolving. That’s why we put together a simple, straightforward guide to help you recognize the red flags, stay one step ahead, and know what to do if something feels off.

Read on to learn how to avoid today’s most common banking scams—including a new Michigan toll text scam targeting local phones

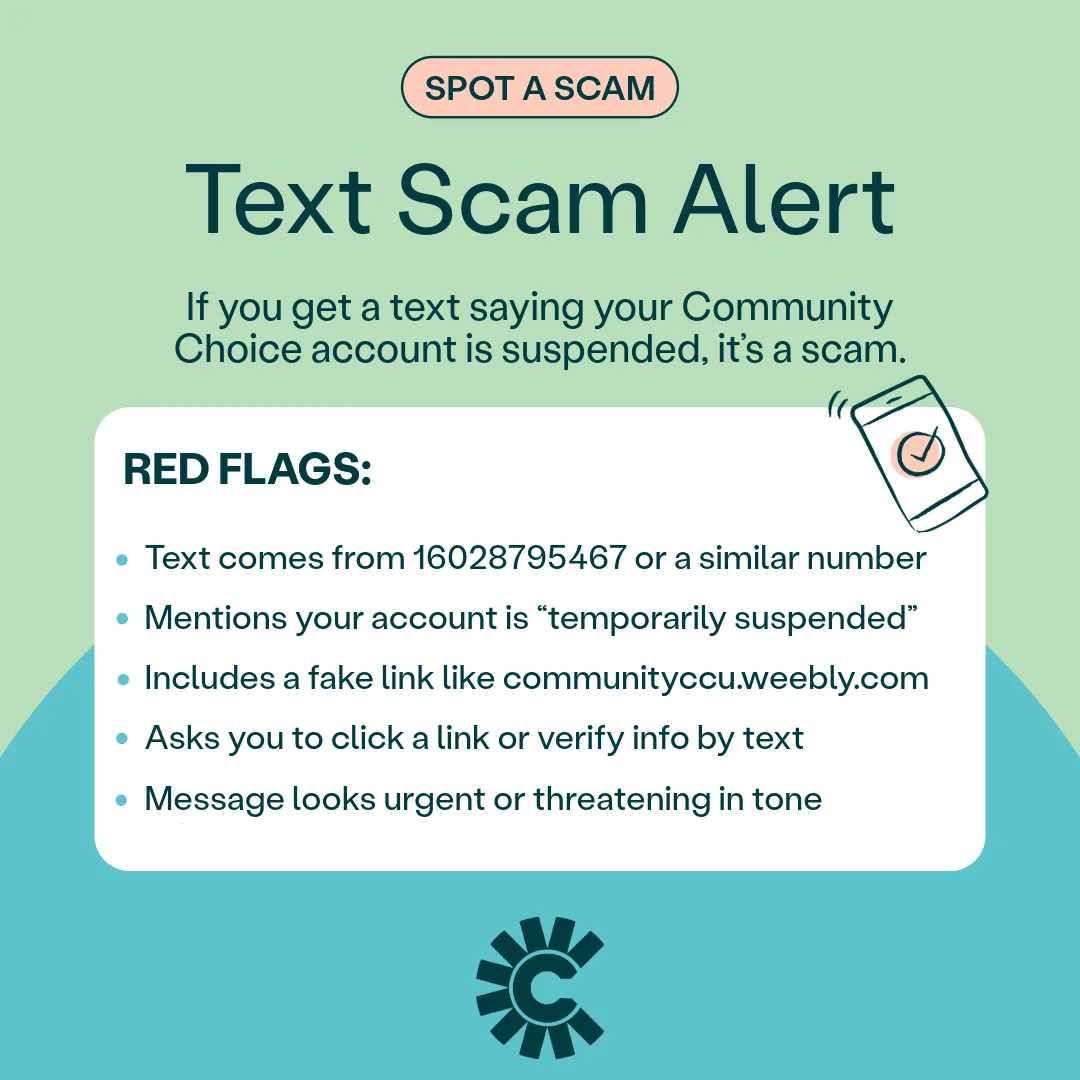

Text Scam Alert

Members have reported receiving text messages claiming their account has been suspended.

This is a fraudulent message, part of a phishing scheme.

Scammers are sending texts to members claiming their account has been “temporarily suspended” and asking them to click on a link to verify their info. This is a scam, intended to get you to panic, click before thinking and give over your personal information.

If you receive a suspicious text:

- Do not click the link

- Do not reply

- Do not send money

- Delete the message immediately

- Forward it to 7726 (SPAM) or report it to ReportFraud.ftc.gov

If you have any questions of concerns, call Community Choice directly at 877.243.2528.

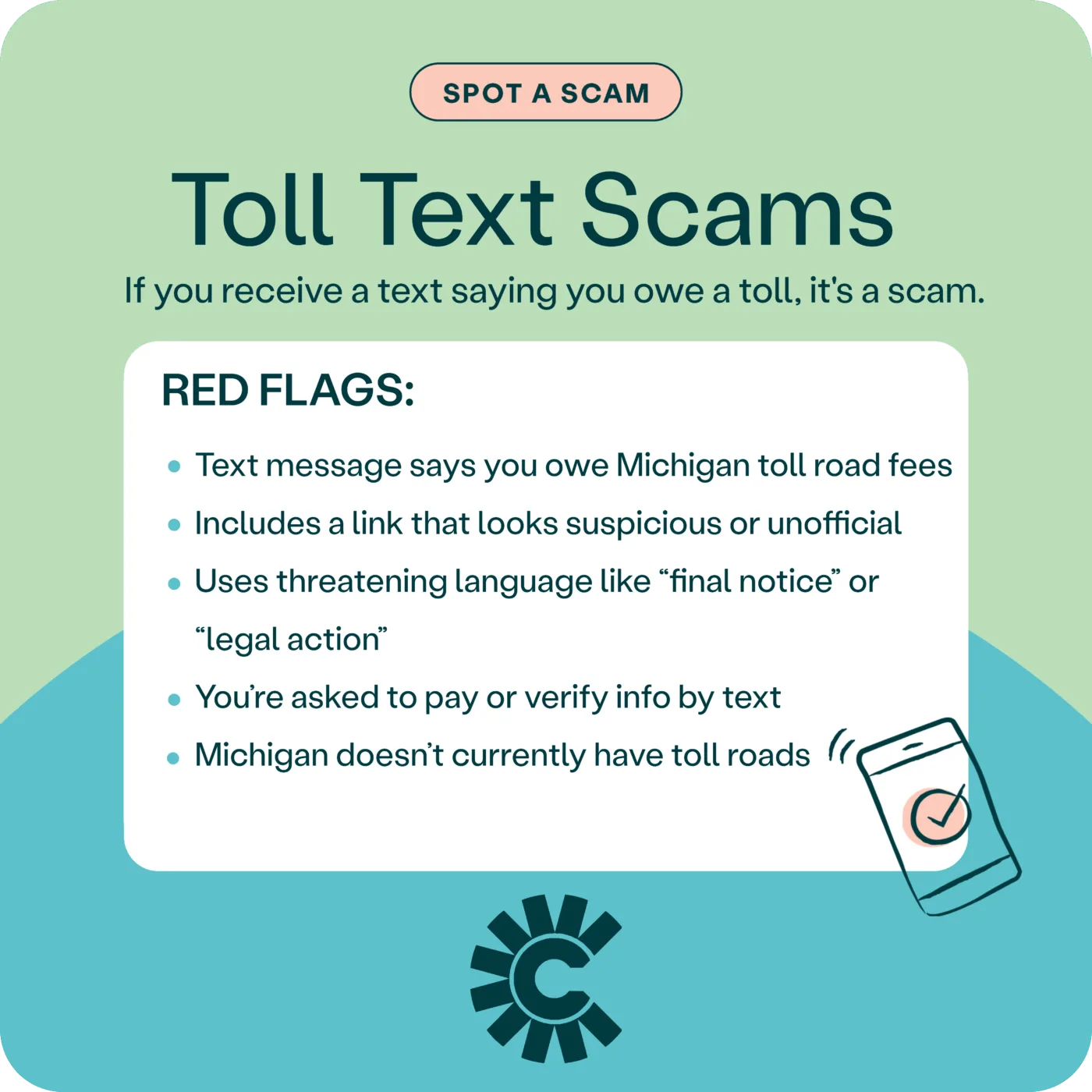

Toll roads? Not in Michigan

Receiving a text that says you owe unpaid toll fees might sound serious—but it’s not legit.

Scammers are impersonating MDOT and using urgency to trick you into handing over sensitive info. Don’t fall for it.

Scammers Are Impersonating MDOT—Stay Alert

A new scam is targeting Michigan residents with texts that appear to be from the Michigan Department of Transportation (MDOT). These messages claim you owe unpaid tolls and threaten legal action if you don’t respond quickly. The goal is to trick you into clicking a link and handing over your personal or financial information.

Here’s the truth:

Michigan doesn’t currently operate toll roads, and MDOT will never text you demanding payment. This is a smishing scam, designed to create urgency and get you to act before thinking.

If you receive a suspicious text:

- Do not click the link

- Do not reply

- Do not send money

- Delete the message immediately

- Forward it to 7726 (SPAM) or report it to ReportFraud.ftc.gov

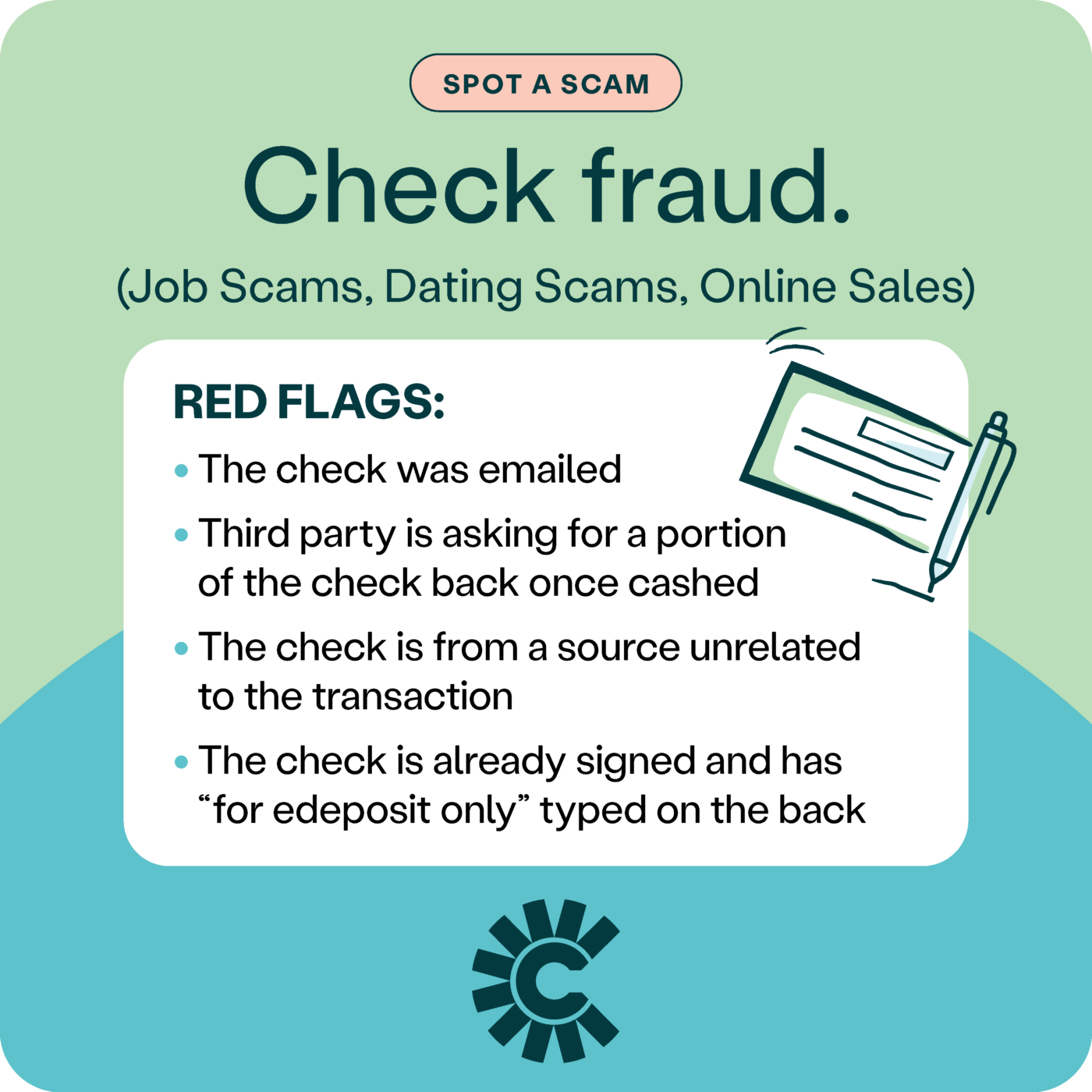

Check usage is down but check fraud remains

While check usage is lower than ever, check fraud scams are not. Receiving an unexpected check, an accidental overpayment, or an offer that promises quick and easy money might seem like good fortune. But, if you’re not careful you could end up scammed out of your own money.

Check Twice for Safety

- Unusual amounts: The check shouldn’t exceed the amount you’re expecting. Ensure the figure is precise, especially with online sales or similar transactions.

- Mismatched details: Verify that the name and address on the check match what you know about the sender. For businesses, confirm legitimacy via the Better Business Bureau or online research.

- Missing features or red flags: Fake checks may lack a signature, bank address, logo, or security features like watermarks. They might also have typos, discoloration, or feel like low-quality paper.

If you haven’t deposited the check, hold off and contact us to discuss your concerns. If you’ve already cashed it, avoid spending the money until the check clears completely.

Make the right connections

Making friends online has become a normal part of life. From social media to gaming communities, the digital world offers endless ways to meet people. While most interactions are genuine, it’s still important to stay cautious. Protect your personal information, watch for red flags, and take your time building trust.

Protect Your Heart – and Your Wallet

You meet someone special on a dating app or on social media. Immediately, they urge you to move the conversation off the platform – after all, it is true love. But there’s a catch—they’re far away, maybe for work or the military. Soon, they ask for money: a plane ticket to visit, emergency surgery, or some other urgent need.

This is the playbook of a romance scammer. They create fake profiles, gain your trust with frequent chats, and spin believable stories to manipulate you into sending money. Stay cautious and protect your heart — and your wallet.

Keep your info off the hook

Scammers are constantly trying to reel you in with tempting offers or urgent requests for personal information. Stay alert by protecting your online details — never share sensitive information with strangers or respond to suspicious messages.

Don’t Take the Bait

Protect yourself by keeping your details private and never responding to unexpected requests for sensitive data. Verify the source of any communication before taking action, and stay cautious with emails, calls, or messages that seem urgent or suspicious.

Check the sender

Unsure of who is really on the line? Don’t rely on caller ID (that can be spoofed, too), and go straight to the source to check the phone number.

Beware of urgency

Think before you click (or call). If someone is asking you to act fast and send them information right away or click on something now – don’t.

Ways to keep your data safe and secure

Avoid clicking on suspicious or unexpected links and trust your gut – if something feels off, it’s likely off. By staying cautious and verifying the legitimacy of requests, you can protect yourself from scams and keep your information secure.

Simple Tips to Protect Yourself

The internet is an incredible tool, offering endless information, resources, and opportunities to connect.

There’s no need to fear using it, but it’s wise to take simple steps to stay safe, like protecting personal information and being cautious with unfamiliar links or requests. With a little care, you can safely and securely enjoy all the internet has to offer.

Community Choice Credit Union will never ask for your account number, card number, PIN, or login credentials via text, phone, or email.

If you ever feel unsure, it’s easy to protect yourself:

- Freeze your card instantly in e-Banking

- Request a new card by phone or online

- Contact us directly—we’re here to help, with secure options that work for you